Contents

fha interest rates texas · Texas 30-year fha mortgage rates 2019 – bestcashcow.com – Texas 30-Year FHA mortgage rates 2019. compare texas 30-Year FHA Mortgage rates with a loan amount of $250,000. Compare Texas 30-Year FHA Mortgage rates with a loan amount of $250,000.

Conventional loans are typically thought of as requiring 20 percent or more of the purchase price for a down payment. However, for the right borrowers with the right mix of credit, debt and income.

Why Pay 20 Down On Mortgage So why haven’t home sales rebounded. But a homeowner who makes a 20% down payment could expect to spend nearly $45 less on monthly mortgage payments, for an annual savings of more than $500, thanks.

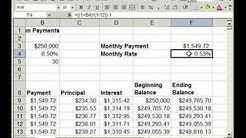

Free FHA loan calculator to find the monthly payment, total interest, and amortization details of an FHA loan, or learn more about FHA loans. Included are options for considering property tax, insurance, fees, and extra payments. Also explore other calculators covering real estate, finance, math, fitness, health, and many more.

Puzzles conventional loan calculator are excellent in helping a child find out difficulty solving abilities. A toddler can start off with an easy 5-part challenge. He starts to create an eye in how stuff can match jointly. Since he improves his skill, provide him a 10-piece challenge.

Up to 97% loan to value with 100% gift down payment feature; Most conventional loans offer the choice between a fixed or adjustable interest rate. When trying to determine if a fixed or adjustable rate best suits your situation, consider the following: fixed-rate mortgage. principal and interest payment remains the same over the life of the loan

There are several tax breaks for homeowners, and the mortgage interest deduction is probably the most well-known. For taxpayers who use itemized deductions, tax-deductible mortgage interest can save.

Home Mortgage Comparison Compare our picks for best VA mortgage lenders of. Ideal for borrowers who want lots of options and a quick turn time. fairway independent Mortgage offers a full selection of home loans along with.Todays Fha Rates The most popular fha home loan is the fixed-rate loan known as the 203(b). It often works well for first time home buyers. It allows individuals to finance up to 96.5% of their home loan and helps to keep down payments and closing costs.

Estimate your closing costs for a mortgage loan. mortgage closing cost calculator – BeSmartee This site attempts to protect users against Cross-Site Request Forgeries attacks.

Estimate your closing costs for a mortgage loan. mortgage closing cost calculator – BeSmartee This site attempts to protect users against Cross-Site Request Forgeries attacks.

It comes as a surprise to some, but one of the myriad benefits of VA loans is that qualified veterans with non-VA home mortgages can refinance into a VA loan and reap the program’s benefits.. The VA Cash-Out refinance is the only way to make it happen. Conventional to Cash-Out. The Cash-Out refinance is one of the VA’s two refinance options.

Conventional loan requirements and qualifications. Loan amount – The loan amount for a conforming mortgage is generally limited to $484,350 for a single-family home, though limits may be higher in regions where home prices are higher. Jumbo loans allow you to exceed the conforming loan limit to borrow for a higher-priced home.